We maintain strict academic integrity standards, To make sure all work is 100% original.

Our affordable rates make our services accessible to all students. We care about your pockets.

We will elevate your GPA to the roof with our peronalized top notch online class help.

We never compromise on privacy, with state-of-the-art data protection measures in place.

- Liberty University

- DeVry University

- Oxford University

- University of Maryland

- Ashford University

- Strayer University

- Terlaton University

- Stevens University

- Baruch University

Pay Someone To Take My Online Class Help Today!

Why settle for low grades when you can achieve academic greatness with our class help? Trust our Award-Winning Online Class Pros to be your ultimate saviors, providing top class support and unbeatable expertise. We'll turn your online course challenges into a walk in the park, helping you achieve your desire grades with ease. Get enrolled today with our pay someone to take my online course service to avail all the benefits.

Get FREE Online Class Help Trial NOW! Limited time offer! ⏱️

Take Online Class Help Today Without Paying Anything Upfront!

Drop your WhatsApp number to get connected with our online class expert!

Our Pay For Online Class Help Offers:

Our results speak louder than words. Explore our services besides take online class help.

Take My Online Class

- All Classes Help: We take all kind of online degree programs or online college courses on your behalf when you can't manage to complete online courses for any reason.

- Personalized Help: We offer personalize services to address individual needs for their online learning help.

- Expert Tutors: We are a team of more than 70+ tutors who can assist every student according to their courses needs.

- 24/7 Availability: Our team is available around the clock, ready to give you updates and online class support.

- Lecture Attendance: We attend online lectures and complete discussions on your behalf, making sure you don't miss anything.

- Assignment Completion: From start to finish, our pay someone to do course online team will take care of everything.

- Flexible Assistance: Either you need help with self pace courses or any custom help we are pretty flexible with that.

- Smooth Process: Our process is quite easy and smooth, You will be assigned an individual tutor for your online class assistance.

- Academic Success: You can put your trust on us to succeed your online classes, helping to get an A/B grades only.

- Privacy Matters: Your identity will always be hidden we provide 100% secure environment for online classes for students.

Take My Online Exam

- Take My Exam: Having challenges preparing for online courses exams? Don't worry you have come to the right place.

- Personalized Exam Help: We customize our help for your needs, either you need help with certification exams or college/university exams.

- Qualified Exam Takers: We hire top graduates from top universities who can ace any classes or exams and end up bringing your desire results.

- 24/7 Exam Support: Don't take stress if you need urgent help with your exams we've got your back just send us instructions and see the magic.

- Proctored Exam Handling: Scared of online proctored exams? Relax! All you have to pretend you are doing the exam meanwhile our tutors will ace it for you.

- Timely Submission: We submit all the exams on time or even before time making sure all the questions are completed and nothing left behind.

- Flexible Exam Solutions: We are flexible with take my online exam help. You can schedule or reschedule exams at anytime if you get in emergency.

- Improvement Guaranteed: You will see an A or 90%+ in your exams results. We take numerous exams daily hence it has made us God of exams.

- 100% Top-Privacy: We understand your privacy concerns this is why we use hidden security bypassing techniques to save your identity.

Subjects We Provide Online Course Help With:

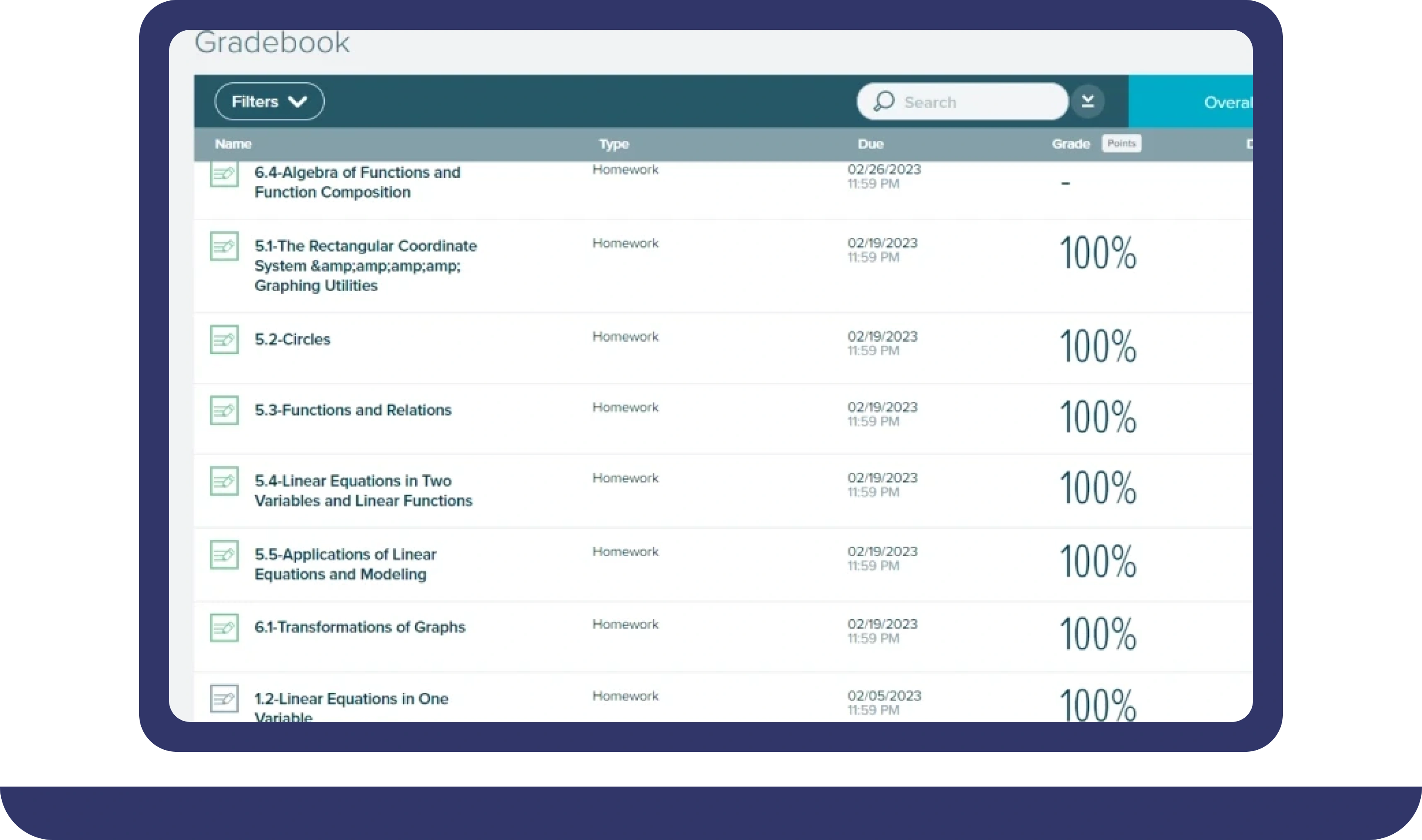

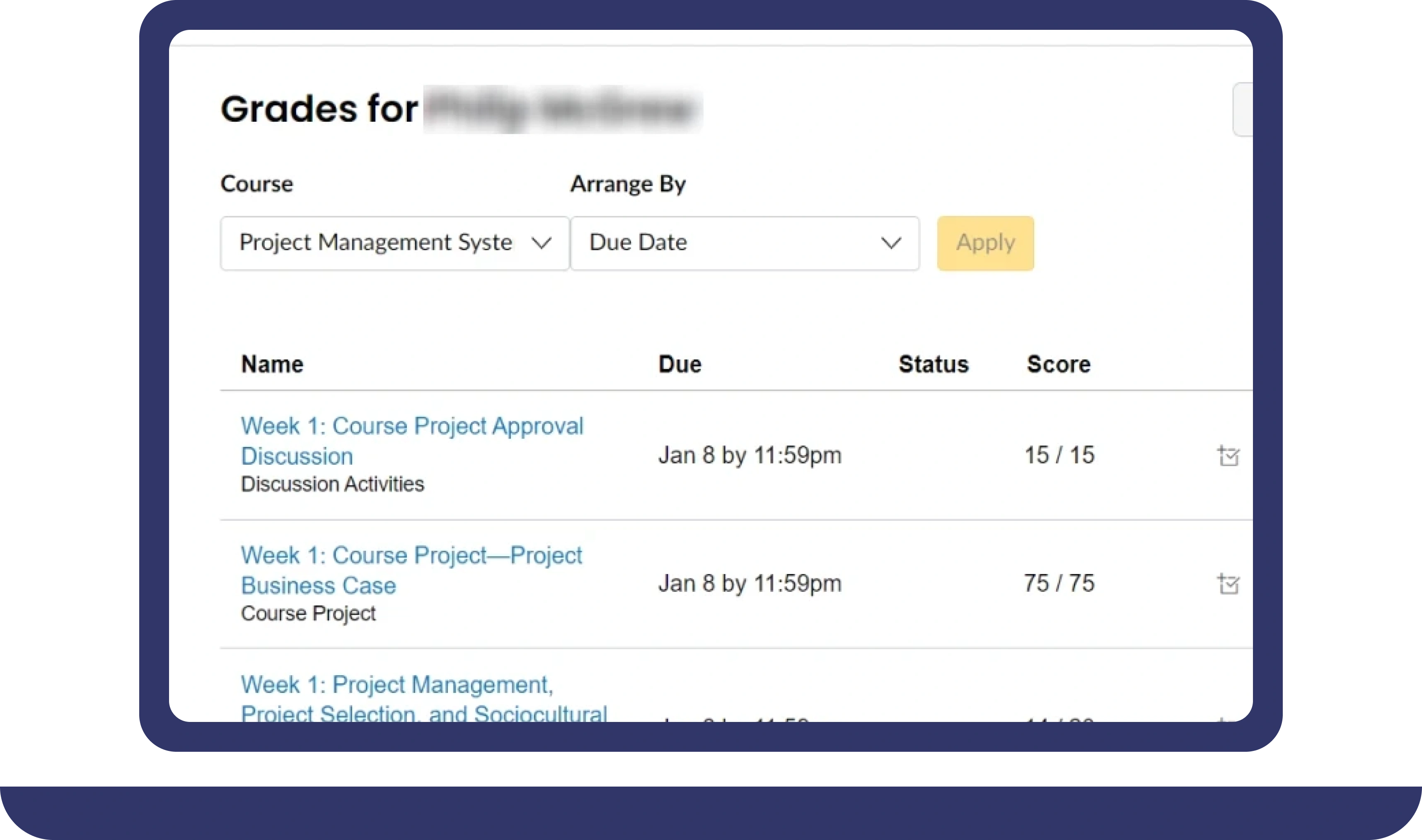

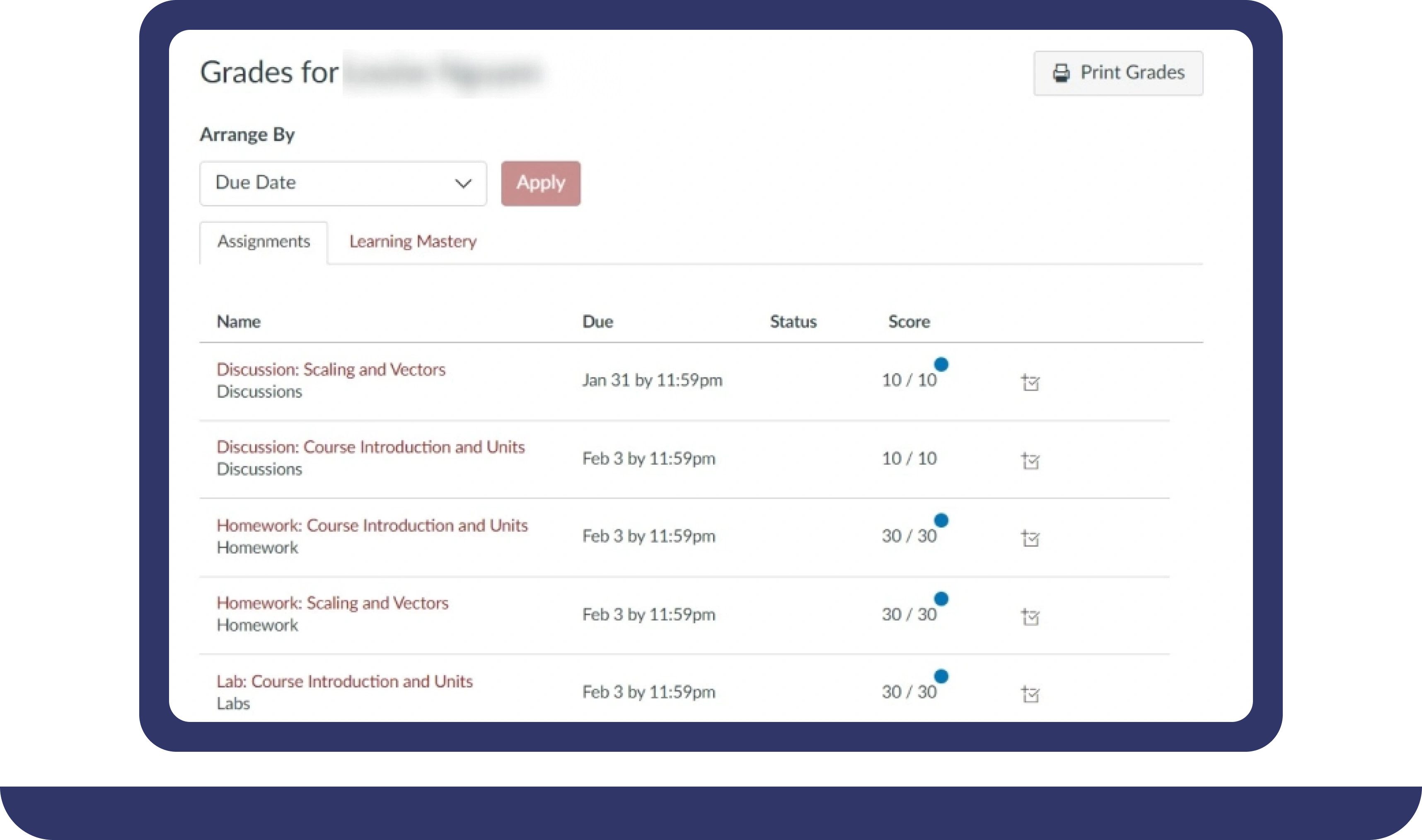

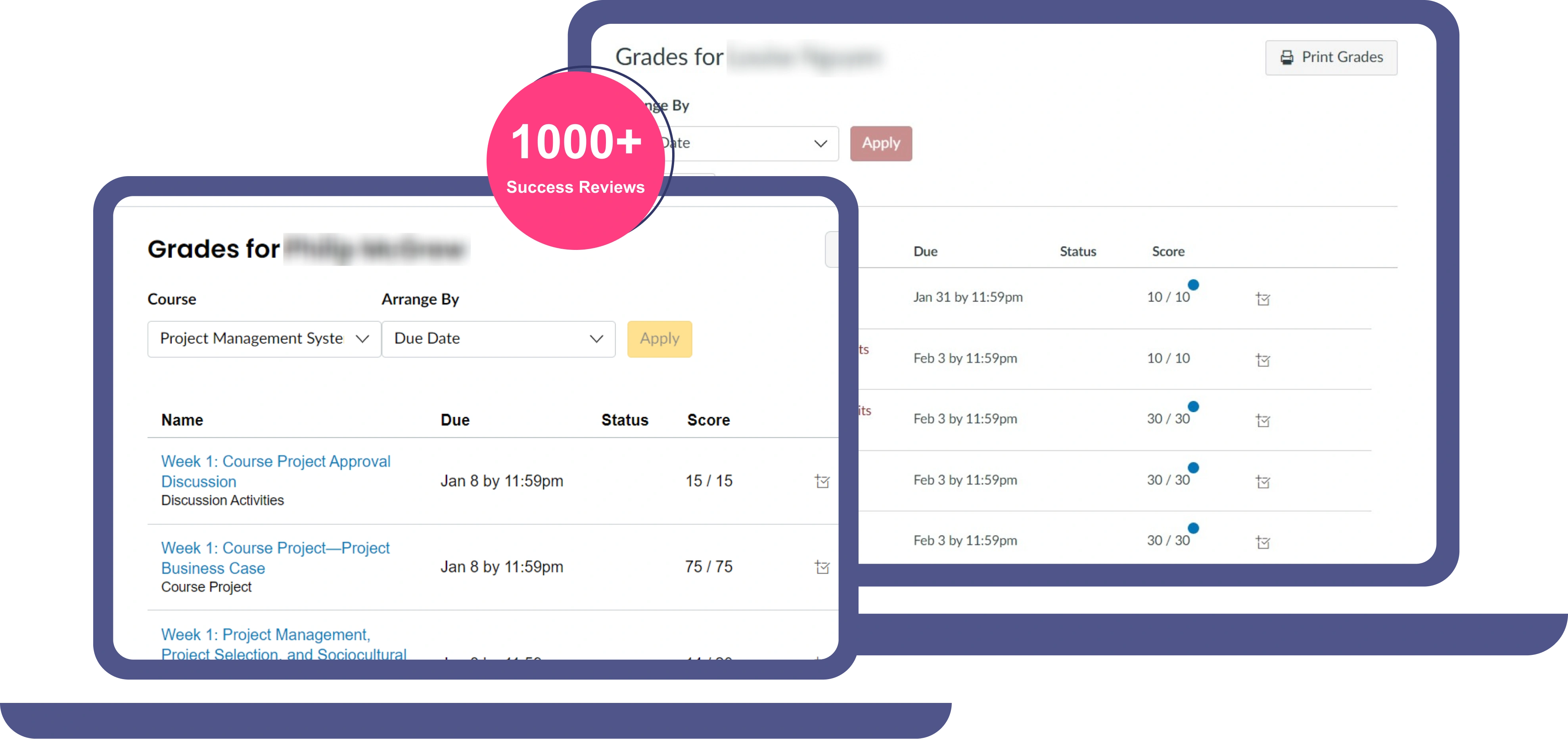

Pay For Grades in My Online Class Success Stories

Why I Want Online Class Help?

- A 7 Days Free Trial Help (Zero Payment)

- B Live Chat for Instant Assistance

- C No Upfront Fees, First Get Your Work Done

- D 1-on-1 Custom Online Tutoring Help

- E USA Based Trusted Service For All Americans

- F Guaranteed High Passing Grades

100%

Trusted

Upgrade Your Performance With Our Online Class Help

Are you stressed out because of your incomplete assignments?You don’t have to stress anymore as you can avail our team of online class help to complete your assignments.You can hire our online course help to boost your academic performance.

Online studies helps students in a way that they can complete work at their own pace and on their own schedule , which supports a wide range of schedules and lifestyles.

Online education helps Students to take advantage with limited mobility by accessing online classes from any location with an internet connection. Class takers online are exceptional at assisting you with your assignments by offering excellent guidance from our highly qualified. Our online course helpers are skilled and proficient enough. They ensure that your course is completed on time leading to academic growth.

No matter how difficult your course is , if you seek online class takers assistance you can easily boost your grades.More than a thousand students' grades have been greatly improved by these online course help, as they have helped them finish their online courses and get excellent scores.

Why To Take online Class Help?

1. Originality: Our online course helpers provide 100% original content and maintain the academic standards.Our professional online class help has authenticity and credibility in their work.

2. Better Academic Performance: Our class takers online can boost your GPA or grades.Our class takers online assist you with top notch services.

3. Cost-friendly Services: Our class takers online deliver class help at affordable prices so that any student can avail it.

4. 100% Privacy: When you hire online class help , you're assured of complete confidentiality and privacy. We take extreme measures to protect your information, by only connecting to your university portal using a VPN with a local IP address. Your data is always kept safe and secure.

Hire Someone To Take My Online Class Now!

With our assistance, you may achieve academic excellence, so why settle for poor grades? Put trust in our prestigious Online Class help, who is known for exceptional help and services. We'll help you easily get over the difficulties in your online courses so you can easily get the marks you want. Enroll in our online class help pro now to take advantage of all its benefits .We have the best online class help to provide top notch guidance for your future.

What does our professional online class help services provide?

1. Always Available: Our online course helpers are available whole day to provide support and guidance to you.

2. All Courses Help: If you're not able to finish your assignment for any reason ,take my online class for best services.

3. Proficient online course helpers:Our online class help pro is passionate to provide guidance and support according to every course’s needs.Their expertise includes a wide range of areas and disciplines, giving students the confidence they need to succeed in their classes. Our best online class help can easily manage complex course because they have an in-depth knowledge of educational technology and online education platforms. Online class help also tells about the easy online classes to take.

4. Attending All Lectures: Our online class helpers make sure to attend every class and discussion on your behalf to make sure you are an active member of your class.

5. Customized Assistance: By creating customized education plans, online class helpers evaluate each student's academic background, preferred method of learning, and academic goals. These plans includes particular topics of focus, learning objectives, and strategies to address individual challenges.

Students who struggle in certain areas are given customized assistance in those areas.Online tutors are able to identify knowledge gaps so they offer customized help.

6. Flexible Pace: Students have the option to learn at their own speed with personalized help. Online tutors can modify the pace and level of difficulty of their lessons to fit the comfort level of their students, making sure they fully understand concepts before advancing to more difficult subjects.

7. Assignment Aubmission: Our pay someone to take my online class team assists from start to end until you’re satisfied with our services and support.We uphold the quality of our services.

8. Flexibility: We are flexible with our online exam help;if you miss your exam due to any reason ,it won’t be a serious problem.Our online class help services are easy to avail and you get individual online help for yourself.

9. Elevated Performance: Online assignment help is establishing itself as a beneficial assistance for students seeking to elevate their academic performance. If you take online class help from experienced online class takers and subject area experts, learners may confidently explore complex subjects and create excellent assignments. This customized assistance meets each student's unique learning demands and helps them to upgrade their grades.

10. Effective Time Management: Online course helper encourages efficient time management, enabling learners to plan their work carefully and easily fulfill due dates. Students thus feel less stressed and more confident in their academic skills, which eventually results in higher grades and excellent academic performance.

11. Maintains Privacy: Our pro online class help services is a secure platform and maintains confidentiality of our clients.

Take Online Class Help For Me:

When you pay to take my class, your burden is reduced.By hiring online class takers, students can find the support they need to thrive in their educational pursuits without sacrificing their other commitments.online class takers provide assistance and support to help students excel in their studies in alongside helping with assignments, tests, and quizzes.Pay someone to take my online class through online course help and enjoy tailored support and expertise to get higher grades.

If you're feeling overwhelmed by your courses and assignments then take online class help for me.

How Do We Provide Online Exam Help?

Our online exam helps students in giving study materials and other resources that are important for the exam subjects. These materials, that help in good preparation, can include study guides, practice tests, lecture notes, and sample questions.

Our online course helpers can provide guidance on exam processes and exam help , including how to structure the questions, manage your time, and respond to various question types in an effective way. With this advice, students can maximize their performance and understand the test with confidence.

Why We Stand Out

We are all about - Commitment, Consistency, and Results.

50,000+ Orders

Proud to be a trusted source of academic support for thousands of students

10+ Years Legacy

With 10+ years of experience, our journey is marked by milestones & achievements.

150+ Skilled Tutors

Expertise from 150+ qualified tutors to ensure an enriching educational journey.

Our Journey: 1,000 Success Stories and Counting

We achieve growth through accomplishments and quality work. Our academic integrity ensures excellence in grades, online exams, and academic tasks, reflecting our commitment to success.

Avail High Quality Online Class Help Irrespective of Your Academic Level

We understand that students have to manage many things simultaneously. Students at all academic levels face somewhat similar challenges.

This is why we offer online class help to students across all academic levels.

Whether you need class help for a science subject or a law one, we provide professional class help tailored to your needs.

Get Personalized Assistance

We aim to provide class help to all the students who struggle to balance their online classes and other commitments. All you need to do is take online class help from our professional online class takers. They will provide you with the best class help that will cater to your class needs.

Get Linked to Our Professional Class Takers Online

Our team consists of class takers online who are skilled individuals. They have years of experience and expertise in a number of subject matters. They can provide you with a premium quality ‘pay someone to take my online class’ service at discounted rates. Our experts not only attend your classes, but they also participate in discussions on your behalf.

Get Online Class Help Pro Anytime

Many students ask us; I need help with my online class and want to take online class help urgently. Can you arrange an online class for me at short notice? You can avail our ‘take my online class’ service any time. We know students have to focus on multiple subjects all at once.

Therefore, we provide online class help services whenever you want. Our class takers online are available all the time to discuss your concerns. Many students get our online class help pro every day because we do not just claim to provide premium quality ‘online class help for me’ service, our results prove it too.

Take Online Class Help from Top-Rated Class Experts at I Want Online Class Help

The goal of our online class help services is to improve students' academic performance. We aim to assist students in managing their responsibilities effectively and alleviating the stress associated with online classes and exams.

Our team consists of top-rated experts who deliver premium quality class help fast. When you feel you are under the heavy weight of online classes, you just need to contact us and ask; Can you take my online class? And our team will deal with the rest! Whether you have easy online classes to take or challenging online tests or exams, we are here to tackle everything for you. Our ‘take my online class’ service is not only flexible but it is designed specifically to meet your online class needs.

Our ‘Pay to Take My Class’ Service Offers Flexibility

Students often wonder, Can I pay someone to take my online class? Can I take online class help without any hassle? We recognize the challenges of balancing academic responsibilities with other commitments. That's why our ‘pay someone to take my online class’ service is designed to be flexible. Simply reach out to us and inquire, I need help with my online class. Can you do it for me? Once you do this, our team of professional class takers and exam takers will be ready to assist you. With our service, you have the freedom to decide when and how you want your classes taken. Moreover, our ‘pay to take my class' service is available nationwide in the USA.

Get Online Class Help Fast: Reliable Assistance When You Need It

Many students inquire; Can you help with my online class? I have some easy online classes to take but can I hire someone to do my online classes? Is it possible for me to get online class help fast?

Classes, tests, and assignments are often announced unexpectedly, leaving students scrambling to fit them into their already busy schedules. We emphasize their struggle, which is why our online class help is designed to be fast and efficient. Our ‘hire someone to take my online class’ service not only offers instant help but also reliability. You can trust us with your classes and get premium quality service at a discounted rate.

Avail Top-Notch Online Exam Help at Budget Friendly Cost

Online education helps students achieve their academic goals by providing many opportunities from the comfort of their homes. However, it requires students to keep up with never-ending online exams and classes. This is why students often find themselves overwhelmed with online exams and classes across multiple subjects. Although they try their best to manage their academic load, it becomes very challenging to do so without asking an outside source for class help or exam help. This is where we come in. We offer top-notch exam help at budget-friendly prices. Our team of experts provides reliable online class help and exam help. With our affordable rates and high-quality service, you will receive the assistance you need to boost your grades.

Instant Support from Expert Exam Takers

Get instant support and assistance from our expert exam takers any time you want. Our team of professional exam takers provides top-notch services as per your needs. Our dedicated team is available 24/7 so that they address your concerns instantly to give you online class help fast.

Achieve Exceptional Results

One of the main reasons students utilize our ‘pay someone to take my online class’ service is to improve their grades. We have a proven track record of providing A and B grades. You can check our online class help reviews to learn about the experiences of hundreds of students who utilized our ‘hire someone to take my online class’ service. Our objective is to deliver exceptional results and help you excel in your online exams. We also offer a money back guarantee in case our expert online exam takers fail to deliver the promised results.

Affordable Prices for All Students

We recognize the financial challenges that many students encounter. That is why we have designed our ‘help with my online class’ service and ‘online exam help’ service in such a way that students with varying budgets can afford it. We offer competitive pricing options to make our high-quality online exam help accessible to all students across the USA.

Leave Your Entire Course to Our Professional Online Course Helpers

Our ‘take my online class’ service not only alleviates the excessive online class burden, but also provides comprehensive course help. Our team comprises professional online course helpers with years of experience in handling courses for students. Our online course helpers have expertise in various subjects. They will give you the best course help in the entire USA. When you take our online course help, we handle every aspect of your course from attending classes to completing online exams on your behalf. So, if you need online class help or online course help, our top-notch course help is readily available. Browse through our online class help reviews, fill out our form and receive prompt assistance right away!

- Expert assistance from professional course helpers

- Comprehensive course help

- Timely submission of assignments, tests, and quizzes

- Instant course help available 24/7

Get 100% Original Assignments

Assignment writing is an important aspect of online courses because teachers use them to evaluate student’s progress. When you take our online course help, we not only provide assignments on your behalf, but we also make sure your assignments are 100% original. We provide plagiarism-free assignments that adhere to the required standards.

Stay Informed on Important Announcements

Our team of online course helpers are able to manage your entire course perfectly. Our course helpers are trained to handle multiple tasks at once. They attend your classes, participate in discussions, do your tests and quizzes for you. Not only this, but they also keep you updated on upcoming tests and assignments.

Leave Your Online Tests to Our Course Helpers

If you have a test that you have not prepared for, trust them to our experts who have expertise in a wide range of subject matter. We make sure that you score A+ grades in all your tests. Avail our ‘take my online class’ service now and achieve your academic goals.

Start Your Success Story: Easy Steps to Get Started

Order Placement

Placing an order at IWantOnlineClassHelp is easy and hassle-free! Just fill out the order form or call us at +1 (657) 300-3540. As soon as you complete your registration process, you'll receive a confirmation email or text from our support team with your next steps of order.

Payment Confirmation

Confirm your payment as quickly as possible, so we can proceed with the order process. We want to make things easy and fast for you. We accept different secure payment methods like Wire Transfers, PayPal, Card, Zelle, CashApp, and Venmo, so you can choose the method that suits you the best.

Order Review

As part of our commitment to excellence, we'll send you a preview of your order before the deadline. Take a moment to review and, if you want to add something, let us know of any changes. We're here to ensure your complete satisfaction with every aspect of your order.

Revision & Feedback

Enjoy unlimited revisions upon receiving your final ordered version. Our commitment to quality aims for your utmost satisfaction. We value your feedback, and if you're pleased with our online class services, feel free to share it. You can provide feedback by filling out the form or sending an email to: [email protected].

Frequently Asked Questions

Yes, you can pay IWantOnlineClassHelp to take your online class. We are a reliable and legit online class taking service. Email us at [email protected] or fill out the form to get a free quote.

Yes, pay IWantOnlineClassHelp to take your online test. We provide 100% confidential and authentic service with a guarantee of plagiarism-free work. IWantOnlineClassHelp also promises to secure only A/B grades (Class, Exam, Homework, etc) on your online test. So, get started now!

We have a team of 135+ highly qualified and skilled homework experts. They are available 24/7 to provide you with top-notch, high-quality service. Our team of live chat representatives is also available round the clock to assist you with any kind of homework-related query (Class, exam, homework, etc.). Get a free quote

Passing an online exam (Class, Exam, Homework, etc) is now easy with our skilled experts. Hire them and have a stress-free experience meeting your deadlines and exam protocols.

Yes, we prioritize your online security. IWantOnlineClassHelp uses top VPN solutions to verify your identity during class logins, ensuring that access comes directly from your location. Our goal is to match you with a local online class expert. If needed, we use IP masking to protect your location privacy.

Yes, we offer a guaranteed refund policy for your satisfaction. If you're not happy with our service, we promise a hassle-free refund. Your peace of mind is important to us.

You can hire someone else to complete the assignment if you can't find the time to take an online course. Hiring a tutor to supervise your online course helps you to reduce the workload and lead you to highest scores.

Yes, we offer a guaranteed refund policy for your satisfaction. If you're not happy with our service, we promise a hassle-free refund. Your peace of mind is important to us.